CAMPAIGNING AND WINNING

By mid-year, there will be a new President who have won the plurality vote. Sure there would be political noise during the national and local elections. It is important to note, however, that President Benigno Aquino III and his allies were the staunchest critics of the preceding administration, and yet there was a smooth transition of power. Philippine politics have relatively matured to compel opposing parties and personalities to accept the verdict of the democratic processes and institutions. This political stability resulted to positive windfall benefit to the economy in the past five years.

MACROECONOMY

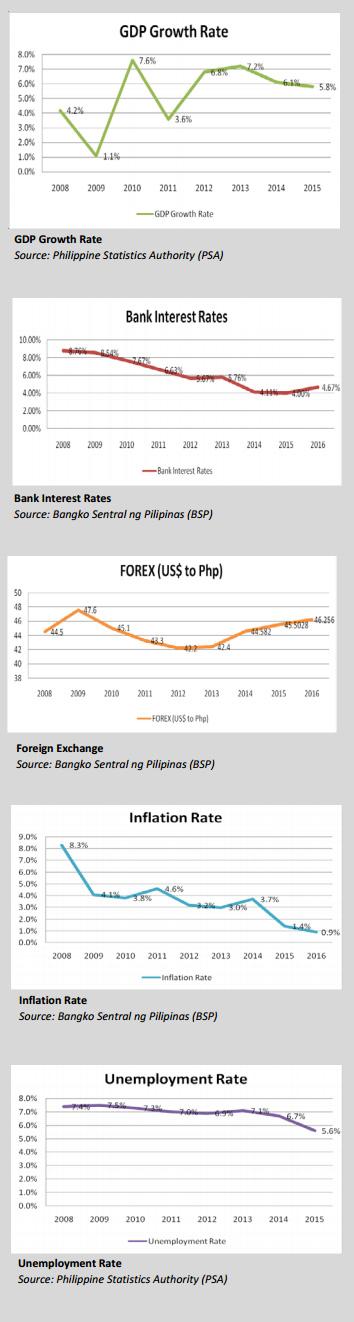

The Philippine government campaigned hard during the last quarter by spending more in infrastructure development, driving the quarterly GDP growth to 6.3%. This effort, however, fell short to reach the full year target growth of 6%, albeit slightly. The latest Philippine Statistics Authority (PSA) data shows that Philippine gross domestic product (GDP) growth is 5.8% for 2015. At any rate, the investment grade of "BBB" has been maintained, and Philippines is doing better than most countries in this cluster according to Fitch Rating.

The Bangko Sentral ng Pilipinas (BSP) latest figures show that the net foreign direct investment (FDI) has been consistently increasing in the past five years. The net FDI reached US$ 6.202 billion in 2014. The net FDI from January to August of last year is pegged at 3.004 billion.

Based on latest BSP statistics, the average bank interest rate inched up to 4.67% as of February of this year as compared to 4.0% by the end of 2015. The Philippine Peso to US Dollar exchange by March 23, 2016 is at Php 46.256, as compared to the average of Php 45.5082 as of last year.

This dollar appreciation is a testament to an improving US economy. Overseas Filipino remittances have been stable. Total remittances for 2015 reached US$25.77 billion compared to US$24.63 billion for 2014, or an increase of 4.6%.

Inflation rate for February 2016 is a low 0.9% compared to 1.4% in 2015 according to BSP. While this is generally correlated to weak economic activity, the labor market is generally stable. The latest unemployment rate data is pegged at 5.8% as of January of this year as compared to 5.6% in 2015.

According to the Department of Tourism, the total Visitor Arrivals in 2015 reached 5.36 million, registering an increase of 11.67% over the arrivals in 2014. Meanwhile, tourism earnings for the same period reached US $ 5billion, up by 3.3% from the US $ 4.84billion earnings in 2014.

WINNING AND WINNERS

There is a saying that winners never quit. In the Philippine real estate market, the winners have been pushing their winnings. The Ayala Land Group has continued to lead the biggest winners by snatching more trophies in recent months. The Group generated revenues from the sale of residential lots and units that reached Php 58.4 billion, 12% higher than the Php 52.3 billion posted in 2014. In terms of reservation sales, the Group generated a total of Php 105.3 billion.

More importantly, the Ayala Group bought 51.06% of Prime Orion that would control the enviable Tutuban Center, which sits on a 20-hectare property. This will also be the location of the North South Railway Project Transfer Station that shall interconnect with the Light Rail Transit 2 West Station. The Group will soon break ground for a 35-hectare mixed-use project along C5 Road in Pasig City, as joint venture development with the LT Group of tycoon Lucio Tan. The Ayala Group, in partnership with Sicogon Development Corp. (SIDECO), which owns more than 800 hectares on Sicogon Island, drew up a plan for a mixed-use real estate venture with resorts, residences, retail shops, forest trails, diving spots, an airport and a port. The Department of Agrarian Reform recently approved of the application for land use conversion of 334.6 hectares in Barangays San Fernando, Alipata and Buaya in Carles town.

The SM Group is another big winner, which reported a 54% year-on-year increase in consolidated net profit to Php 28.3 billion for 2015, buoyed by a Php 7.4-billion one-time trading gain on marketable securities booked in the first quarter of 2015. Without this one-time item, net income climbed 14% year on year to Php 20.9 billion last year, slightly faster than the 13% jump to Php 18.39 billion in 2014. This is the biggest advantage of the SM Group, the high recurring income due to its 58 malls, and other smaller platforms such as Supermarkets, Hypermarkets, Savemore and WalterMart stores.

The Group is planning to have 10.96 million square meters of shopping malls in the Philippines and China; over 139,000 residential units across 41 projects; 2,500 units of leisure homes across 16 developments; 460,000 square meters of commercial space from seven office buildings; and 2,187 hotel rooms from 10 hotel developments by 2018.

The SM Group has been venturing in low cost housing with units sold at below Php 3 million each. Apart from affordability, the Group gets incentive from the Bureau of Investments (BOI). It reportedly owns the top five biggest projects registered with the BOI in the past two years.

Another source of recurring income of SM Group is its successful foray in the office market by taking advantage of the strong demand from business process outsourcing (BPO) companies. The Group will soon launch its 18-storey SM City BPO Twin Tower in Iloilo City.

The Megaworld Group is another big winner. While its patriarch Andrew Tan recently pulled a powerful coup de grace by acquiring the international brand "Fundador" and presumably will embark on integration with its successful local "Emperador" brand, it also completed 16 residential projects and six BPO office towers with retail components across its integrated urban townships.

Megaworld currently has 20 integrated urban townships across the country, and its total land bank spans over 4,000 hectares nationwide. Additionally, it is set to launch 14 office towers, malls, and commercial centers in McKinley West, Uptown Bonifacio, The Mactan Newtown, Iloilo Business Park, Arcovia City, Southwoods City, and in Alabang. The Megaworld Group owns 100% of Suntrust Properties, 82% of GERI, and 82% of Empire East. It has already built over 350 residential, office, and commercial towers around the country.

The Vista Land Group has been winning its own trophies as well. The Group purchased Boracay Sands Hotel on the last business day of last year, shelling out Php 157 million in cash for the 55-room property. Apart from its successful residential platform and steadily increasing mall floor area, its convenience store business "All Day" has already reached nearly 100 stores strategically placed in various Villar property developments.

Another big winner is the Filinvest Group with its joint venture with the Bases Conversion and Development Authority (BCDA) for the 288-hectare Clark Green City and its long-term lease with the 201-hectare former Mimosa Leisure Estate from Clark Development Corporation. The Group reported

a total consolidated revenues of Php 16.53 billion in 2015 from Php 15.46 billion in 2014, or an increase of 7% boosted by robust real estate rental and sales. Real estate sales increased by 6.4% to Php 14 billion with nearly 80% of the sales coming from units sold to the middle income market, including medium-rise and high-rise buildings. Rental sales grew 9.7% to Php 2.48 billion, mainly due to higher rental revenues and increased occupancy take up from office developments. Its operating regular net income reached Php 5.11 billion in 2015 from Php 4.6 billion in 2014, or an increase of 10.9%.

The Robinson Group is keeping its winnings in recurring income. Revenues increased by 16% to Php 19.73 billion in 2015 from P17.05 billion in 2014, as the commercial centers, office buildings, hotels and residential segments chalked up double-digit growth rates. Recurring revenues from its commercial centers, offices and hotels divisions account for 66% of its total revenue. By the end of its fiscal year, Robinsons Group has 40 commercial centers, 11 office buildings and 14 hotel properties.

Robinson's hotel division registered revenues of Php 1.75 billion, a 14% increase compared to the same period in 2014. It is now looking to have roughly 4,100 rooms by 2020, a growth of 86% from its existing 2,200 rooms.

Apart from SM and Robinsons Groups that rely on recurring retail space rentals, the Gaisano-led Metro Retail Stores Group Inc. (MRSGI) currently has a network of 46 stores serving an estimated 250,000 customers daily. It is composed of 24 supermarkets, 12 hypermarkets and 10 department stores. It plans to open up to 70 more stores nationwide in the next five years. One of the new department stores with supermarket will be in Ayala-owned shopping in the Pasig-Marikina area. Two other department stores would be in Bacolod City and Iloilo. And another two more supermarkets will also be opened in Mandaue and Cebu. The Group built and opened its first department store and supermarket in Metro Manila in 2004, the Metro Market! Market! in the Bonifacio Global City.

OFFICE MARKET

The business process outsourcing (BPO) industry is still the main driver of the office market in the coming years. Buoyed by this strong demand, more than 1 million square meters of office space are planned to open in the next two years in major business districts in Metro Manila. While this total seems high, it is important to note that overall vacancy across these business districts is still at a manageable 6%, from 5% by end of 2015. Overall Grade A and Prime Grade A office stock in Metro Manila is approximately 5 million square meters.

Pinnacle Research still opines that big tenants would still have a hard time looking for suitable office, especially if they need contiguous floors. It is still a landlord's market, thus, the landlords are still the winners in this segment. Rents in Makati Central Business District (CBD) generally held up, where Premium Grade A buildings have a weighted average of Php 1,280 per sqm per month, Grade A buildings have a weighted average is Php 865 per sqm per month, and for Grade B&C Buildings, the weighted average is Php 675 per sqm per month. Pinnacle Research observed that some Grade B&C Buildings, and even Grade A Buildings are slightly lowering their asking rates due to competition from newer and better stocks in BGC, and other CBDs.

The weighted average rent in BGC of Php 870 per sqm per month is comparable to slightly higher when compared to Makati Grade A buildings. The average rent of Grade A office buildings in Ortigas, Alabang, Quezon City, and Bay Area business districts is estimated at Php 650 per sqm per month. For comparison, in Cebu average Grade A office rent is Php 500 per sqm per month, while in Davao the average rent is Php 450 per square meter.

RESIDENTIAL MARKET

Much has been said about the fear of property bubble in the residential condominium market. Given the estimated demand for housing at 5.5 million for this year, it is really a concern of right match of the supply being built vis-a-vis the actual demand. What is a more accurate picture is that the residential segment of the real estate market is the most competitive at present since a lot of players have experienced high profitability in recent years. Given the numerous developments in Metro Manila, the winners in this property segment are the buyers since there are a lot of choices, and financing is relatively easy. Likewise, future tenants of these residential units, especially those units bought as investment, would also be winners, enjoying the available choices as well as the competitive rents.

Rents have been generally stable, given the wide range of options in the market. Luxury condominium units command the highest rents that plateaued at Php 300,000 per month-level for big units of 300 sqm-cut. The typical rental range for luxury two-bedroom and three-bedroom units is between Php 120,000 to Php 250,000 depending on the size, location and furnishing. For the luxury and high-end segment, there are limited choices for rent.

Leasing of studio and one-bedroom units is stable and still ranges between Php 15,000 to Php 30,000, and may reach the Php 50,000 per month-level, depending on the location, furnishing, and amenities of the condominium building. It would be worthwhile to monitor the rents of one-bedroom and studio units to evaluate the yields of these “investment units.”

One big winner in providing affordable housing is the maverick 8990 Group. The Group breezily reached a net income of Php 4.05 billion in 2015 coming from its 11 ongoing projects. The 8990 Group will start 14 new projects this year, adding 75,608 units to the inventory in the coming years. For 2016 alone, the Group will build 12,453 housing units, where 46% would come from Luzon, 30% from the Visayas, and 24% from Mindanao.

In addition, the 8990 Group is gearing up to service housing demands in other countries, especially in the ASEAN Region. The Group has been in joint venture discussions for projects in Tanzania and Dubai. It was also invited by the Malaysian Prime Minister to participate in constructing one million housing units in Malaysia, and reportedly to have a deal with the Malaysian government that is close to consummation.

The JNJ Summithill Group is another maverick that is successful in servicing a market niche, building "dormitels" near major universities. Its first project is the "Upad" in the vicinity of De La Salle University-College of St. Benilde and St. Scholastica's College offering rooms that can be shared by two, three, four or even six students. Of course, professionals can opt to lease one room for himself/herself alone. Apart from very plush room amenities, Upad has a gym and a pool supporting the healthy lifestyle of the young students and professionals or "millennials". The building is practically 100% occupied.

Its second project is along P. Campa St. in Manila City, which is very close to the University of Sto. Tomas and just backing the Professional Regulation Commission (PRC) head office. It is still finishing the interiors of the ninth floor to the penthouse, and yet eight floors are already leased out even if tenants have to endure the noise and dust of construction. This just shows how strong the demand is in the area.

RETAIL MARKET

The biggest winners in this property market segment have been the SM Group, Robinsons Group and Cosco/Puregold Group. The SM Group intends to increase its 58 malls to 61 this year, apart from its joint venture with Double Dragon to build CityMalls nationwide. It even expanded its SM Cinemas to 307 screens across the country with total seats of 141,753 by the end of 2015, or an increase of 12% from the previous year.

Robinsons Group has 40 malls at present and intends to build three-to-four mall per year to reach 55 malls by 2020. The Group is also operating more than 400 Ministop stores around the Philippines. Cosco/Puregold Group has 36 stores and is planning to open eight stores in the next three years.

The big players are the winners in consolidating the industry and integrating the various retail platforms. Ultimately, the consumers are the winners since there have more choices of locations and platforms nationwide.

HOTEL AND GAMING MARKET

Tourism has been touted as a growth area and a steady dollar earner. Tourist arrivals have been record-breaking in recent years, although the 6 million-per year mark is still to be reached. In this vein, the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) has been tasked to give incentives to investors and developers in the tourism industry to accelerate developments, much like what the Philippine Economic Zone Authority (PEZA) is doing in the manufacturing, information technology and related industries. The designated tourism enterprise zones (TEZs) are in Bulacan (Ciudad de Victoria); Cebu (Queen's Castle); Davao (Hijo); Dumaguete (Bravo Golf Resort); and Manila (Resorts World).

TIEZA is not only waiting for proponents to seek accreditation. It also identified flagship TEZs to spur developments in then various regions. At present, the identified flagship TEZs are in Bataan (Mt. Samat Shrine); Bohol (South Palms); Manila (Rizal Park); Palawan (San Vicente); and Surigao Del Norte (Kapihan Nature and Adventure Park). There will be another flagship TEZ to achieve the target of six.

In the previous report, Pinnacle Research identified the various projects of the different developers. What is key is the breadth of developments across the country, and is not limited to the big players. Recent news-makers not coming from the big developers include the 400-hectare Pradera Verde estate in Barangay Prado Siongco, Lubao, Pampanga and Poro Point La Union.

The Pradera Verde has a nearly completed a world-class 36-hole championship golf course and is hosting the third edition of the highly anticipated Lubao International Hot Air Balloon Festival. Poro Point, on the other hand, is inside the former US radar facility in San Fernando City and has been hosting the Sillag Festival, which is similar to Bangus Fest in Dagupan City, Panagbenga in Baguio City and Ati-Atihan in Aklan. The Sillag Festival literally means festival of lights or moonbeam since La Union is in the middle of the sea where ships and fishermen have been passing through since the 14th Century.

According to the Department of Tourism, there were 8,856 accommodation enterprises with a total room capacity of 204,700 rooms nationwide by the end of 2015. Based on the latest available figures, hotel occupancy rates in Metro Manila slipped to an average of 68% percent in the first half 2015. As earlier reported, this report did not dissuade the first and second tier players as they are building hotels all over the country, especially in hot tourism markets.

While the diligent players would capture the demand for hotel and leisure, and the clear winners would be both the local and foreign tourists since there will be more choices of tourist spots, events and accommodations.

INDUSTRIAL MARKET

The biggest winner in this segment in recent months is the Filinvest Group due to its development rights on the 288-hectare Clark Green City and long term lease of the 201-hectare former Mimosa Leisure Estate. Filinvest would presumably take advantage of the pent up demand for industrial spaces, and blend in mixed developments to increase the level of success and profitability.

As earlier reported, there are 316 operating economic zones at present. The Ayala Group’s Alviera Industrial Park (AIP) in Porac, Pampanga is likewise positioned to capture the demand for industrial spaces. The 31-hectare industrial park has been reported to have sold some lots already.

The winners here are the developers since the demand is high at present; the locators as well, since they will have new options; and the Filipino labor force since there would be new jobs that will be created. These industrial zones would also spur development in the surrounding localities.

WINNERS

Quitters never win, and as mentioned above, the big players are not quitting, even with the election-related noises, they are pushing with their developments to reach the broadest possible market and offer the most number of choices. With or without elections, the top players and mavericks will take advantage of the under-served demand in the market.

In Philippine politics, some losers never quit, too. Ultimately, it would be the Filipino electorate who would choose the winners, and in turn, the democratic process and sustained economic development would be the clear winner. This would then have positive impact on the real estate market.

Download the PDF Version