CLEARING AND CLEANING UP FOR THE NEW YEAR

It is a Filipino tradition to put up decors and lights in anticipation of the Christmas and New Year. Clearing old items and cleaning up the house is a typical precursor to this annual chore. For corporations, there is also clearing of inventories and cleaning up of reports and business plans before the year ends. Some publicly-listed companies are even said to be “window-dressing”. While the Chinese New Year is on February 8, 2016, preparations are being made to welcome the Fire-Monkey Year. On the political front, the New Year is also highly anticipated due to the heating up national elections. Firing the monkeys is easier said than done, but in spite of politics, the economy and the real estate industry is projected to weather the political noise.

MACROECONOMY

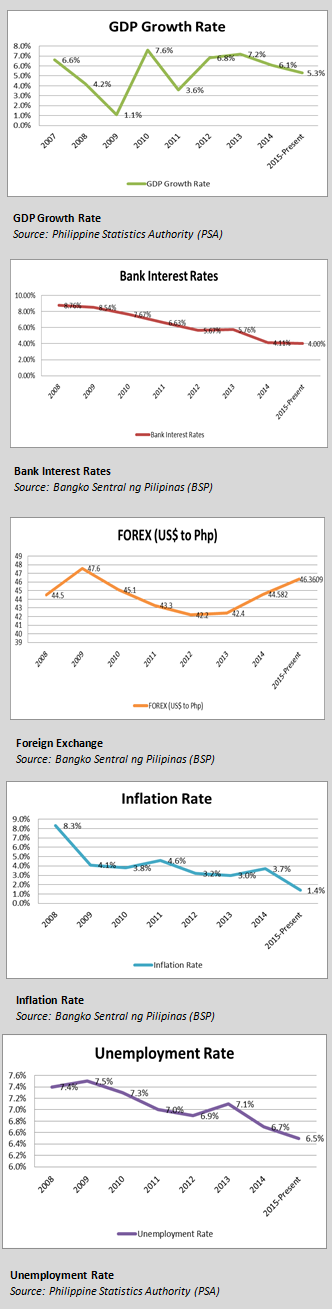

Philippine Statistics Authority (PSA) data shows that the country’s gross domestic product (GDP) grew by 5.3%, which is 5.6% higher year-on-year. The full year target for 2015 is maintained at 6% growth. While the government is still trying to catch up with its spending, the target is relatively lower compared to the past three years. The government is reported to have lined up nine additional railway projects costing US$ 20.9billion or PHP 961billion to ease traffic congestion in Metro Manila. The Philippines also secured an Official Development Assistance (ODA) from Japan worth ¥241.991-billion or Php 93.457billion for the construction of the railway project linking Metro Manila to neighboring Bulacan province in the north.

Thus, Philippine economy is very stable and is at par or better than other emerging economies. Based on a Business World article on December 8, 2015, the Fitch Rating stated that the country’s growth remains notable against prospects of other sovereigns in the same “BBB” cluster.

The Bangko Sentral ng Pilipinas (BSP) latest figures show that the net foreign direct investment (FDI) has been consistently increasing in the past five years. The net FDI reached US$ 6.202 billion in 2014. The net FDI from January to August of this year is pegged at 3.004 billion.

The Bangko Sentral ng Pilipinas (BSP) latest figures show that the net foreign direct investment (FDI) has been consistently increasing in the past five years. The net FDI reached US$ 6.202 billion in 2014. The net FDI from January to August of this year is pegged at 3.004 billion.

Based on latest BSP statistics, the average bank interest rate dipped to 4.0% as of June of this year as compared to 4.11% by the end of 2014. The average Philippine Peso to US Dollar exchange in October of this year is observed at Php 46.36, as compared to Php 44.582 by end of last year. This substantial dollar appreciation is a testament to an improving US economy. Overseas Filipino remittances have been stable. For January to September of this year, remittances reached US$18.408 billion compared to US$17.682 billion for the same period last year, or an increase of 4.1%.This is a good sign that the US$ 20 billion-mark shall be breached again this year.

Inflation rate from January to October 2015 is 1.4% compared to 3.7% by the end 2014 according to BSP. While this is generally correlated to weak economic activity, the slightly lower unemployment presents a stable labor market. The latest unemployment rate data is pegged at 6.5% as of July of this year as compared to 6.7% in 2014.

According to the Department of Tourism, the total Visitor Arrivals from January to September of this year reached 3,983,627, registering an increase of 10.76% over the last year’s arrivals of 3,596,523 for the same period. Visitors from South Korea still claim the top spot at 997,135 arrivals or 25.03% of the total; second from the United States with 577,508 visitors; and third from Japan with 380,815 arrivals. Visitors from China ranked a close fourth with 373,795 visitors. Tourism earnings for the first nine months of the year reached Php 168.75 billion, up by 6.99% from the Php 157.73 billion earnings for the same period last year.

THE 600-POUND GORILLAS

In sync with the upcoming Year of the Monkey, the top real estate developers may be likened to 600-pound gorillas that dominate the forest. The Ayala Land Group leads the biggies by building townships all over the country. The Group generated revenues from property development reaching Php 75.1 billion for the first nine months as compared to the same period last year of Php 68.3 billion or 10% higher. This includes the sale of residential lots and units, and office spaces, as well as commercial and industrial lots. Leasing revenues, which includes the operation of shopping centers, offices, and hotels and resorts, reached Php 17.2 billion, or 12% higher than the Php 15.4 billion recorded last year.

Based on the Group’s report for the three quarters of 2015, Ayala Land Premier posted revenues of Php 15.7 billion from Php 14.9, or 6% percent higher for the same period in 2014. Alveo reported Php 10.1 billion in revenues from Php 7.0 billion, or 43% percent due to higher contribution from subdivision projects. Avida recorded Php 10.3 billion in revenues, which 12% percent higher compared to the same period last year. Amaia registered revenues of Php 2.8 billion or 16% higher compared to the same period in 2014. It’s socialized housing unit, BellaVita, reported revenues of Php 272.0 million from last year’s revenue of Php 76.0 million, or a phenomenal 257.89% increase. The residential business group posted reservation sales of Php 82.9 billion, which 4% higher than last year’s Php 79.71 billion.

The commercial business meanwhile saw revenues from shopping centers reach P9.2 billion, 12 percent higher than last year’s Php 8.3 billion while revenues from office leasing reached Php 3.7 billion, 18% higher than last year’s Php 3.1 billion due to the contribution of new offices and the higher occupancy and average rental rates of existing offices. Ayala Land Group’s tourism business meanwhile saw revenues from hotels and resorts reach Php 4.3 billion, which is 7% higher than last year’s Php 4 billion.

Based on the Group’s report for the three quarters of 2015, Ayala Land Premier posted revenues of Php 15.7 billion from Php 14.9, or 6% percent higher for the same period in 2014. Alveo reported Php 10.1 billion in revenues from Php 7.0 billion, or 43% percent due to higher contribution from subdivision projects. Avida recorded Php 10.3 billion in revenues, which 12% percent higher compared to the same period last year. Amaia registered revenues of Php 2.8 billion or 16% higher compared to the same period in 2014. It’s socialized housing unit, BellaVita, reported revenues of Php 272.0 million from last year’s revenue of Php 76.0 million, or a phenomenal 257.89% increase. The residential business group posted reservation sales of Php 82.9 billion, which 4% higher than last year’s Php 79.71 billion.

The SM Group is another “600-pound gorilla” dominating the market. The group is securing its top position in the retail market. By the end of 2015, the SM Group will have 55 malls in the Philippines, the largest in the country, and even have six malls in China, for a total estimated Gross Floor Area (GFA) of 8,269,486 million square meters. Recurring income has been the focus of the Group, even securing stable income from office buildings.

On the residential front, SM Group is sellling an average of 15,000 units every year. Based on Housing and Land Use Regulatory Board (HLURB) figures, the average license to sell given to condominium developments has an average of approximately 75,000 per year. SM Group intends to increase its annuals sales to the 20,000-unit level, thereby solidifying its market share in the condominium segment.

Another big “gorilla” is the Megaworld Group that has been busy with its five new townships all over the country. The group also announced its intention of catching up in the retail mall segment by building 20 malls in the next five year. In terms of clearing up inventories, it reported to have sold around 80% of the 788 residential lots in its 62-hectare Alabang West development. This resulted to a rapid increase in land values to Php 56,000 per sqm from Php 47,000 per sqm, or 19% appreciation in just 11 months after the launch of the subdivision.

The Vista Land Group has been pushing major real estate projects all over the country, with its patriarch declaring that he will stay away from politics. The Group already unveiled 27 projects in the previous months that may rake in Php 20.7 billion of sales, plus the additional planned launches with estimated sales value of Php 15 billion. The Vista Land Group has been beefing up its AllDay and AllHome retail platforms to drive recurring income. The Group is also including office spaces in its offering presumably to get a slice of the BPO market. The Vista Land Group also made inroads in the health care business with its 100-bed hospital project in the Daang Hari vicinity. The Group intends to replicate its 30-year old Golden Haven Memorial Parks business all over the country. While it has exposures in Las Piñas, Cebu, Cagayan de Oro, Zamboanga, Iloilo and Bulacan, the Group will open its branches in Pampanga and Nueva Vizcaya soon. Vista Land Group is upbeat about the memorial parks business that it will double its current nine sites by next year, and plans to put at least 100 sites all over the country.

DMCI Group will launch nine projects next year with approximately 14,000 units and estimated sales value of Php 50 billion. Likewise, the Group intends to generate recurring income when it launches its 36-storey office project along Pasong Tamo in Makati City. This will have over 40,000 square meters of leasable area, subject to approval of permits and licenses.

Eton Properties, the real estate unit of the Lucio Tan Group, will continue to focus in generating income by building more office buildings to meet the growing demand in the BPO-IT industry. Eton has already built office buildings with a total leasable area of 124,000 square meters. It intends to build an additional of 200,000 sqm of leasable office spaces.

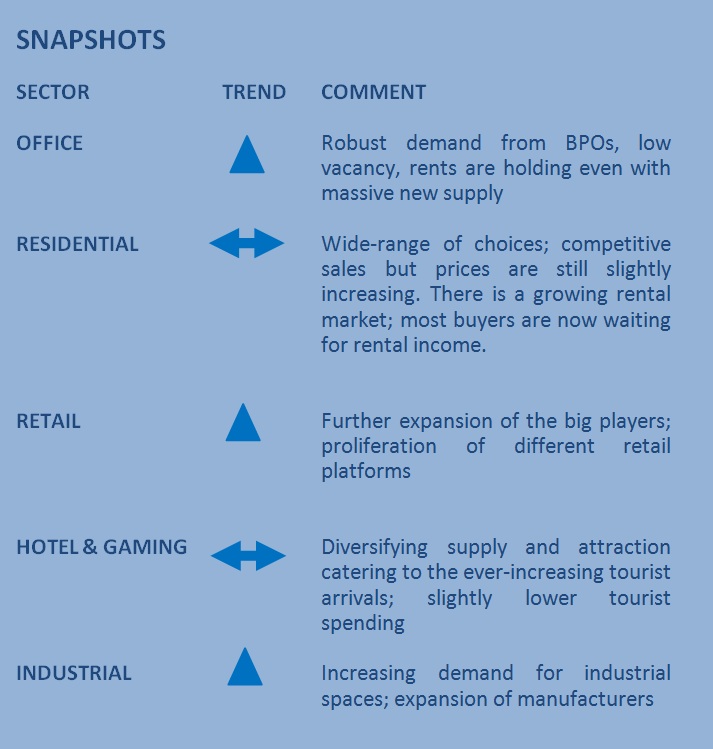

OFFICE MARKET

According to industry sources, the business process outsourcing (BPO) industry is expected to end the year with 1.2 million employees, which is very close to the next year’s goal of hitting 1.3 million jobs. Revenue-wise, the BPO industry generated total revenue of US$ 18.9 billion in 2014, and expect to between 15%-18% this year. The 2016 revenue target is pegged at US$ 25 billion.

Revenues from the BPO industry are projected to soon overtake dollar remittances by overseas Filipinos given the strong growth of the industry. It would be most likely to happen in two years according to an HSBC economist in a briefing. Industry sources confirmed that they are now gearing up the “Next 10 Cities.” These cities are: Baguio City, Davao City, Dumaguete City, Iloilo City, Lipa City, Metro Bulacan (Baliuag, Calumpit, Malolos City, Marilao and Meycauayan City), Metro Cavite (Bacoor City, Dasmariñas City and Imus City), Metro Laguna (Calamba City, Los Baños and Sta. Rosa City), Metro Naga (Naga City and Pili), and Metro Rizal (Antipolo City, Cainta and Taytay).

Pinnacle Research monitored a phenomenal take up of approximately 200,000 sqm of office space in the past three months, most of which were pre-leased. The overall vacancy rate of major business districts in Metro Manila is still below 5% even with the new buildings coming online. Makati office spaces still command the highest rents, but with the influx of modern Bonifacio Global City (BGC) buildings, there is a slight downward pressure on Makati rents. While rents in Makati generally held up, where Premium Grade A buildings have a weighted average of Php 1,280 per sqm per month, Grade A buildings have a weighted average is Php 865 per sqm per month, and for Grade B&C Buildings, the weighted average is Php 675 per sqm per month, Pinnacle Research observed that some Grade B&C Buildings, and even Grade A Buildings are slightly lowering their asking rates due to competition from newer and better stocks in BGC, and other CBDs.

The weighted average rent in BGC of Php 870 per sqm per month is comparable to slightly higher when compared to Makati Grade A buildings. The average rent of Grade A office buildings in Ortigas, Alabang, Quezon City, and Bay Area business districts is estimated at Php 650 per sqm per month. For comparison, in Cebu and Davao, average Grade A office rent is Php 450 per sqm per month

RESIDENTIAL MARKET

This segment of the real estate market is the most competitive at present since a lot of players have been cashing in from this very profitable property sector. Whispers of property bubble are even pertaining to a smaller segment, the condominium market.

It is a well-known fact that most developers have been targeting overseas Filipinos. In addition, a lot of buyers have been promised of “good investments.” At this point, delivery of new residential condominium units is expected for the rest of 2015. Condominium buyers who are expecting rental income would like to see how their yields would flow in, especially if these purchases are leveraged with bank financing.

At any rate, the top players are not shying away from competition. As mentioned above, the SM Group intends to sell at an annual average of 20,000 units starting next year. DMCI announced that it would launch 14,000 units next year. The Ayala Land Group and Ortigas & Company have packaged their residential projects with mixed used and township developments.

Leasing of residential condominium units continues to be steady. Rents have been generally stable, given the wide range of options in the market. Luxury condominium units command the highest rents that plateaued at Php 300,000 per month-level for big units of 300 sqm-cut. The typical rental range for luxury two-bedroom and three-bedroom units is between Php 120,000 to Php 250,000 depending on the size, location and furnishing. Leasing of studio and one-bedroom units ranges between Php 15,000 to Php 30,000, and may reach the Php 50,000 per month-level, depending on the location, furnishing, and amenities of the condominium building. It would be worthwhile to monitor the rents of one-bedroom and studio units in the coming months since this would spell the yields of the “investment units.”

More importantly, the residential market is not just condominium market. Based on the nine-year average of HLURB data, the condominium market is 27% of all licenses to sell. Open market subdivisions and townhouses comprise 22% of the market. Economic housing accounts for 27%, and socialized projects accounts for 24%. To reiterate the previous Pinnacle Report, the National Economic and Development Authority (NEDA) estimated the housing need is approximately 800,000 per annum; of this, close to 400,000 households annually can afford to buy housing units while the remaining households are mainly from the informal settler families. The private real estate developers typically target to carve a market share from this 400,000 per annum demand for housing all over the Philippines.

The Ayala Group has set its sight on the economic housing by beefing up the projects under the Amaia brand. This is very timely given the recent increase of the economic housing loan limit from Php 1.25 million to Php 1.7 million as approved by the Housing and Urban Development Coordinating Council (HUDCC). In addition, its Bella Vita brand has been making inroads in the socialized market.

RETAIL MARKET

The retail market has been dominated by the “600-pound gorillas” like the SM Group, Robinsons Group and Cosco/Puregold Group. SM Group has 55 stores, 41 SM Supermarkets, 43 SM Hypermarkets, 127 Savemore stores and 27 WalterMart stores. The Group reopened the three Cherry Foodarama stores recently acquire. SM also teamed up with the Indonesian Alfamart to venture on the operations of initially 50 minimarts. For community malls, SM’s joint venture with by DoubleDragon to put up 100 CityMalls is well underway. The partnership already secured more than 30 sites all over the country and intends to open 25 stores by next year.

Robinsons Land Group has 37 malls and operating more than 400 Ministop stores. Cosco/Puregold Group 36 stores with a total GFA of 367,000 sqm. The Group is planning to open eight stores in the next three years.

The other big players like the Ayala Land Group and Megaworld will not easily be put away and are aggressively pursuing their own retail strategies. The Ayala Land Group is planning to open at least five new shopping malls in the next few years in line with its goal to earn a net income of Php 40 billion by 2020. The Group also partnered with the Visayan retail giant Metro Retail Stores conferring to the latter the anchor tenant status in four shopping centers, namely: Capitol Central in Bacolod City, Negros Occidental; The Shops at Atria in Mandurriao, Iloilo City; Central Bloc in Cebu City; and the Ayala Malls Feliz in Cainta, Rizal. For its part, the Megaworld Group is joining the race with its plan of putting up 20 malls in the next five years.

The past quarter showed another top player that would not shy away from competition. The Vista Land Group acquired 88.25% of Starmalls, Inc. from the Fine Group to officially seal the merger. The Group is integrating its retail platforms with its housing projects and intends to open six to seven “AllHome” annually over the next five years. The Group has identified about 100 areas from its existing Camella projects around the country with ready population catchment areas for potential Starmalls projects. With Starmalls adding to Vista Land’s recurring revenue stream, the leasing side of the business may eventually account for 20% of revenues and earnings before interest, taxes, depreciation, and amortization (EBITDA).

All of these top players are jockeying for retail market share to increase their annual recurring income.

HOTEL AND GAMING MARKET

Hotel occupancy rates in Manila slipped to an average of 68% percent in the first half of the year, just 1.6%-points lower than the rates a year ago, according to a report by the United Nations World Tourism Organization (UNWTO) report. Even with this slight decrease, Philippines is actually doing better than most countries in Southeast where drops ranged from 2.1%-points (Singapore) to as high as 8.6%-points (Bali). Only Thailand and Vietnam bucked the trend with slight increase in occupancy. This is quite surprising given that the current Philippine-China dispute resulted to a travel advisory from the Chinese government discouraging its citizen to travel to the Philippines. As reported above, total tourist arrival from China still rank fourth but the growth plateaued, where it was at pace to overtake the tourist arrivals from Japan over a year ago.

At any rate, the top players are not dissuaded in expanding their hotel business. Tourist arrivals and receipts from tourists have been increasing every year. Robinsons Land Group is steadily beefing up its Go Hotel brand. At present, it has nine sites: Bacolod, Butuan, Dumaguete, Iloilo, EDSA-Mandaluyong, Ortigas Center, Otis-Manila, Puerto Princesa and Tacloban.

The Filinvest Group is beefing up its hotel portfolio and rebranded its Filarchipelago Hospitality, Inc. to Chroma Hospitality, Inc. that would offer hotel management services to third parties. They intend to reach have 5,000 keys by 2020 from its current 1,063 keys in Alabang and Cebu.

Chroma Hospitality is spending as much as Php 2.6 billion for a 228-room Canvas Hotel in Cubao and a 185-room Canvas Hotel in Mactan. The Group is bringing to the market a Crimson Hotel in Boracay; Quest Hotels in Dumaguete and Tagaytay; Canvas Hotels and Resorts in Cubao, Mactan and Cebu City; and a Serulyan condotel in Mactan. These hotels will open between 2018 and 2019. Chroma Hospitality are looking to expand in Pasig and Quezon City as well as in other provincial areas such as Batangas, Cavite, Laoag, Baguio, Cebu and Davao.

The Ayala Land Group plans to put up Seda hotels across the country in the next five years. It is even considering bringing the Seda brand broad. The Ayala group currently has four Seda hotels located in Bonifacio Global City, Cagayan de Oro City, Davao City and Sta. Rosa, Laguna. The target opening of the on-going developments with nearly 2,000 hotel rooms will be from 2016 to 2018. Under its Vision 2020, the Ayala Group plans to achieve a portfolio of 6,000 hotel and resort keys.

The Rockwell/Lopez Group opened its first Aruga hotel-serviced apartments in Rockwell Center, Makati. It is offering 114 units of studio, one-bedroom and two-bedroom, catering to mobile businessmen and professionals. The Group is actively looking for possible expansion sites.

Red Planet, formerly Tune Hotel, now has 10 hotels. The new Red Planet hotel brand is targeting travelers prioritizing value, cleanliness, effectiveness and connectivity. The new Red Planet hotel brand also features its new mobile app that has both booking and stay-in mode functions that provide holistic assistance to travelers. It plans to have 20 hotels in the Philippines in five years. The Red Planet Group has 24 hotels, consisting of 3,783 rooms in Japan, Thailand, Indonesia, and the Philippines.

Gaisano-led Grand Land Inc. (GLI) will start its construction of its hotel in the Cebu North Reclamation Area and will be spending about Php 2 billion for the 30-storey mixed-use project. This project includes office and retail spaces, and a condotel. GLI recently signed a partnership with the Thai hospitality firm Dusit International to manage the hotel component of the mixed-use development.

A positive blip in the hotel market is the successful partnership of a local real estate developer in Cebu with one of Japan’s largest hotel chains to build a 583-room in Mandaue City. Everjust Realty Development Corp. and Toyoko Inn target to open a business hotel in JCenter in Mandaue by next year. The new hotel building in Mandaue City will be leased to Toyoko Inn Group for 25 years. The Japanese brand has more than 200 hotels in Japan and six in Korea.

Another maverick not only in the residential market but also in the hotel market is the 8990 Holdings, which owns the imposing Azalea hotel in Boracay and another one in Baguio. The company will build three more Azalea hotels and residences in Cebu, Davao and Clark. Each hotel will have 100 rooms.

The Lao family is venturing into the hospitality business with the development of a 150-room serviced apartment/hotel in Filinvest City, Alabang. This will be managed by the Ascott Group under the brand “Somerset Alabang.” The new hotel is targeted to be opened by 2017.

INDUSTRIAL MARKET

It takes time to develop a full-blown industrial/economic zone with Philippine Economic Zone Authority (PEZA) accreditation. At present, there are 316 operating economic zones. Apart from these, the Clark Special Economic Zone (CLARK) and the Subic Bay Freeport Zone (SUBIC) have offered thousands of hectares to manufacturers in the past. Most of these economic and special zones have limited manufacturing/industrial spaces for lease.

The big news in recent months is the winning bid of the Filinvest Group to develop the more than 200-hectare Clark Green City. The development would probably be mixed-use with some industrial/manufacturing spaces to take advantage of the influx of international manufacturers coming to the Philippines.

Another notable PEZA-accredited industrial zone under construction is the Ayala Land Group’s Alviera Industrial Park (AIP) in Porac, Pampanga. The 31-hectare industrial park has been reported to have sold some lots already. AIP is seen to complement the industrial hubs in CLARK and SUBIC, targeting companies in light to medium, non-polluting enterprises.

CLEARING THE HURDLE

While it is typical for companies to sprint to the tape or finish line before the year ends, or “finish the year strong”, especially for publicly-listed entities, the real estate market may be viewed as a long distance marathon. Developing real estate products takes months, and even years. True, there are ways on how to push forward profitability. For some developers, they would turnover their products ahead of time to collect the “bullet” or “lump sum” payments. Some commercials spaces like malls, hotels and even offices would bump up profitability by squeezing interested tenants on weekly or monthly basis, who would in turn take advantage of the shopping season before Christmas. Even open spaces and parking lots are transformed into “tiangge” to serve the shoppers.

By now, most companies would have put their best foot forward. If there are still inventory left for sale, they would aggressively clear them during the holiday season that would be teeming with dollar-rich balikbayans or overseas Filipinos. They should also offer discounts to take advantage of the Christmas bonuses of the local buyers. Business plans would have been cleaned up in preparation for the New Year. Return on investments and hurdle rates would have been reviewed and sharpened.

For real estate developers, they would also be considering the highest and best use of their lands and resources. Constructions and developments are time-consuming and labor-intensive. The first two years are typically in the red, which is considered a major “hurdle” in the property market. This is the reason why due diligence and market scanning is very important in any segment of the property market. Maximizing the liquidity of the financial market is also important to overcome this hurdle. This is the advantage of the stable and low interest rate regime.

By now, politicians and political parties are cleaning up their campaign lines, and political alignments are becoming clearer. While there would be a semblance of civility and peace during the Christmas season, all gloves would be off by next year. Political noise may sharpen to election mudslinging. Charges and counter-charges would be thrown among the candidates. Surveys would be cheered and jeered. At any rate, all of these parties and politicians would have to pass the hurdle that is getting enough votes from their constituents.

Download the PDF Version